The average is computed using the same formula as the accounts receivable turnover ratio above. Inventory may be the largest dollar amount on the balance sheet, and a big use of your available cash. Your goal is to buy enough inventory to fill customer orders, but not so much that you deplete your bank account. If you have too much cash tied up in inventory, you may not have enough short-term liquidity to operate the business.

Cash Flow – Factors to Consider When Analyzing Current Ratio

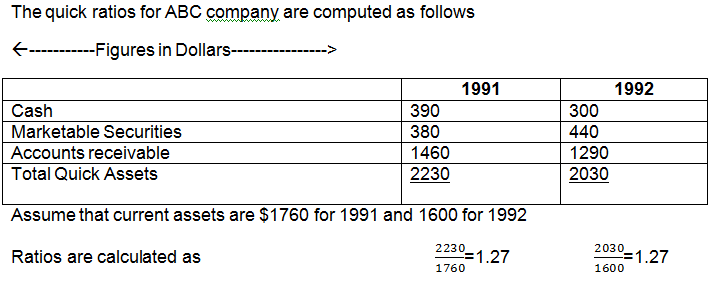

First, the quick ratio excludes inventory and prepaid expenses from liquid assets, with the rationale being that inventory and prepaid expenses are not that liquid. Prepaid expenses can’t be accessed immediately to cover debts, and inventory takes time to sell. Business owners and the financial team within a company may use the current ratio to get an idea of their business’s financial well-being.

Operational Efficiency – Why Is the Current Ratio Important to Investors and Stakeholders?

This is because inventory can be more challenging to convert into cash quickly than other current assets and may be subject to write-downs or obsolescence. Inventory management issues can also lead to a decrease in the current ratio. If the company holds too much inventory that is not selling, it can tie up cash and reduce the current ratio.

Possible industry applications of the quick ratio

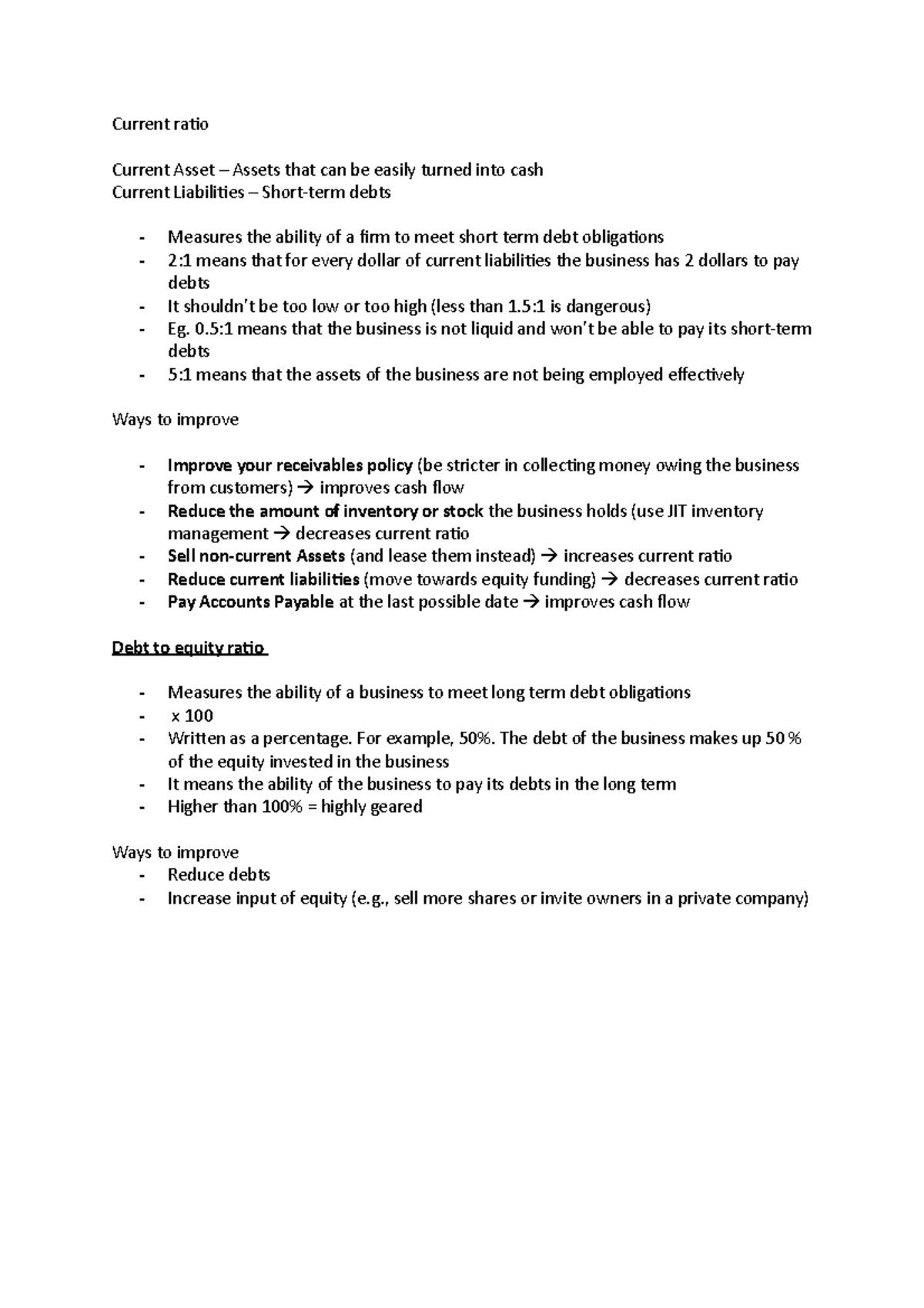

By increasing its current assets, a company can improve its ability to meet short-term obligations. You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities. Again, current assets are resources that can quickly be converted into cash within a year or less, including cash, accounts receivable and inventories. Comparing the Current Ratio with other liquidity ratios, like the Quick Ratio or the Cash Ratio, can offer a more nuanced view of a company’s financial health.

The current ratio (also known as the current asset ratio, the current liquidity ratio, or the working capital ratio) is a financial analysis tool used to determine the short-term liquidity of a business. It takes all of your company’s current assets, compares them to your short-term liabilities, and tells you whether you have enough of the former to pay for the latter. Since the current hire accountants ratio compares a company’s current assets to its current liabilities, the required inputs can be found on the balance sheet. The current ratio is a liquidity measurement used to track how well a company may be able to meet its short-term debt obligations. Measurements less than 1.0 indicate a company’s potential inability to use current resources to fund short-term obligations.

Current Ratio Vs Quick Ratio

As mentioned, the current ratio is calculated by dividing a company’s assets by its liabilities. Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable and short-term debt. The current ratio provides insight into a company’s liquidity and financial health. It helps investors, creditors, and other stakeholders evaluate a company’s ability to meet its short-term financial obligations. A high current ratio indicates that a company has a solid ability to meet its short-term obligations.

Excess inventory can tie up cash and reduce a company’s ability to meet short-term obligations. A company can reduce inventory levels and increase its current ratio by improving inventory management. The regulatory environment in the industry can affect a company’s current ratio. Companies in heavily regulated industries may need to maintain higher current assets to meet regulatory requirements. Companies may need to maintain higher current assets in a highly competitive industry to meet their short-term obligations in a downturn.

- Current ratios can vary depending on industry, size of company, and economic conditions.

- Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan.

- You’ll want to consider the current ratio if you’re investing in a company.

- As a general rule of thumb, a current ratio between 1.2 and 2 is considered good.

Particularly interesting may be the return on equity calculator and the return on assets calculator. Be sure also to visit the Sortino ratio calculator that indicates the return of an investment considering its risk. This can be achieved through better forecasting and demand planning, more efficient production processes, or just-in-time inventory management.

Current assets include cash, accounts receivable, inventory, and any other assets expected to be converted into cash within a year. Current liabilities, on the other hand, are debts and obligations due within the same timeframe. The current ratio equation is a crucial financial metric, that assesses a company’s short-term liquidity by comparing its current assets to its current liabilities. A ratio above 1 indicates the company can meet its short-term obligations, while below 1 suggests potential liquidity issues.

This current ratio guide will cover everything you need about the current ratio, including its definition, formula, and examples. The denominator in the Current Ratio formula, current liabilities, includes all the company’s short-term obligations, i.e., those due within one year. It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future. The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables.