Non-cumulative preferred stock does not offer the same protection for missed dividends as its cumulative counterpart. If a company decides not to pay a dividend in a given year, shareholders of non-cumulative preferred stock have no claim to those unpaid dividends in the future. This type of stock is generally less attractive to conservative investors but may appeal to those willing to take on more risk for potentially higher returns. From an accounting perspective, non-cumulative preferred stock simplifies dividend tracking, as there are no accrued liabilities for unpaid dividends. Corporations offer several types of preferred stock with different features and privileges, like cumulative, noncumulative, participating, convertible, and nonconvertible preferred shares. This article briefly explains what is convertible preferred stock and how the conversion of preferred shares to common shares is journalized in the books of issuing entity.

Trial Balance

By capturing these changes, the statement provides a dynamic view of the company’s equity structure, highlighting how preferred stock transactions influence overall equity. This comprehensive approach ensures that all aspects of preferred stock are accurately represented, offering a holistic view of the company’s financial position. Earnings Per Share (EPS) is a crucial metric for investors, as it provides insight into a company’s profitability on a per-share basis.

Accounting for Preferred Stock: A Comprehensive Guide

Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. Preferred stock where the dividend could gain or loss be more than the original, stated dividend. In each case the term deposit journal entries show the debit and credit account together with a brief narrative.

Features Offered in Preferred Stock

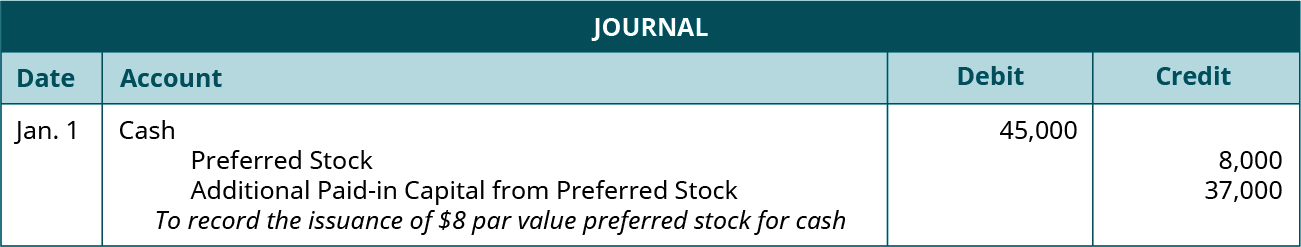

Using the example above, the business issued 1,000 7% preferred shares with a par value of 100, so the annual dividend on each preferred share is calculated as follows. Another critical aspect of initial measurement is the classification of preferred stock. Depending on its features, preferred stock can be classified as either equity or a liability. For instance, if the preferred stock is mandatorily redeemable at a fixed date, it is classified as a liability because it represents an obligation to transfer assets in the future. Conversely, if the stock lacks a mandatory redemption feature and does not impose an obligation on the company, it is classified as equity. This classification impacts the company’s leverage ratios and overall financial health, making it a crucial consideration for both management and investors.

The accounting for convertible preferred stock requires careful attention to the terms of conversion and the potential impact on the company’s equity structure. When conversion occurs, the company must reclassify the preferred stock as common stock on the balance sheet. To illustrate how preferred stock works, let’s assume a corporation has issued preferred stock with a stated annual dividend of $9 per year.

Balance Sheet

For companies, issuing preferred stock can be an attractive way to raise capital without diluting control. The most common approach seems to be to first remove any capital in excess of cost recorded by the sale of earlier shares of treasury stock at above cost. If that balance is not large enough to absorb the entire reduction, a decrease is made in retained earnings as shown below. The $100,000 balance in capital in excess of cost-treasury stock was created in the previous journal entry.

In a 2-for-1 conversion, 100,000 preferred shares shall be converted to 200,000 shares. If the stated value is $10 per share, credit to common stock account would amount to the product of the number of common shares issued and the par value. Companies often establish two separate “capital in excess of par value” accounts—one for common stock and one for preferred stock. They are then frequently combined in reporting the balances within stockholders’ equity. The disclosure of preferred stock details in the notes to the financial statements is equally important.

- Corporations are able to offer a variety of features in their preferred stock, with the goal of making the stock more attractive to potential investors.

- The dividend on preferred stock is usually stated as a percentage of its par value.

- The amount at which the holder of preferred stock or bonds must sell the stock or bonds back to the issuing corporation.

- Preferred stock comes in various forms, each with distinct features that cater to different investor needs and corporate strategies.

In other words, a 9% preferred stock with a par value of $50 being issued or traded in a market demanding 9% would sell for $50. On the other hand, if the market demands 8.9% and the stock is a 9% preferred stock with a par value of $50, then the stock will sell for slightly more than $50 as investors see an advantage in these shares. Convertible preferred stock and convertible bonds are both dilutive securities i.e., they both can reduce firm’s earnings per share (EPS) if holders opt for conversion. The key difference between two convertibles is their distinct classification at the time of issuance. All types of preferred stock, including convertible ones, are classified as stockholders’ equity item unless a mandatory redemption exists.

The additional paid-in capital is a part of total paid up capital that increases the stockholders’ equity. The distinct features attached with common stock and preferred stock discussed above appeal to different classes of investors. Thus, rather than relying only on common stock, many corporations prefer to issue both types of stock to attract as many investors as possible. Preferred stock is often known as a hybrid security since it generally combines the features of both equity and debt. From stockholders point of view, the negative aspect of this class of stock is that it does not possess the voting power. It means, the preferred stockholders are not entitled to vote for the election of directors and other important matters of the corporation.

Participating preferred stock provides shareholders with the opportunity to receive additional dividends beyond the fixed rate, contingent on the company achieving certain financial milestones. In the event of liquidation, participating preferred shareholders may also receive a share of the remaining assets after all other claims have been settled. This type of stock is appealing to investors who want both stability and the potential for higher returns. Accounting for participating preferred stock involves not only tracking the fixed dividends but also calculating any additional dividends based on the company’s performance. Roberts Corporation issued 4,000 common shares of $10 par value each upon conversion of 2,000 preferred shares of $55 par value each.